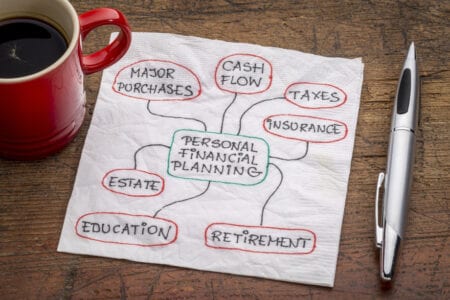

“How can physicians shrink tax debt?” Every day, doctors of every age and station ask us this question. at Invent Wealth. In fact, we answer this question so often that we view it as one of the big secrets to a happy, comfortable physician’s life. You see, our first answer is that you must gain knowledge of personal and professional finances.

We help physicians gain this fiscal education, because, as we have said many times, medical schools do not teach financial savvy to physicians.

The Short Answer to How Physicians Shrink Tax Debt: Financial Literacy

In addition to the above short answer, we have several long, multi-faceted answers as to how you can shrink your tax debt. Those solutions must be individualized for every physician. That is why we ask you to analyze your long-term and short-term financial goals shortly after we meet you.

It won’t take you long to figure out that you cannot “fix” financial mismanagement simply by improving a few of your tax returns.

However, being aware of a few tax management tips can start you on the road to physical health. This article focus on two tax mismanagement tips common to many physicians. There’s no doubt Invent Wealth can help physicians shrink tax debt, but that is not all there is to gaining true fiscal awareness, financial goals and tax management.

Do Some Doctors Incur Tax Mismanagement when Physicians Shrink Tax Debt?

Recently we have seen several doctors jump at investment schemes just because they vaguely think the investments will lower their tax bills. (In fact, most accountants know physicians are fairly infamous for this type of behavior.) For example, let’s look at the most common type of physician tax dollar mismanagement:

Tax Mismanagement 1: The Curious Case of Young Dr. Lux

Young Dr. Lux has decided he will participate in one of his more mature colleague’s favorite investments. (He learned about the opportunity in the Doctor’s Lounge. He was honored to invest.)

However, young Dr. Lux has not yet maxed out his 401(k) or IRA. (He has also bought a big house and a really nice sports car. But, that is a different issue.)

Thus he is committing to outside investment before he invests in his own future—Perhaps he does not realize the 401K and the IRA are the simplest of tax shelters.

You do not have to take our word for the existence of this behavior. It is also a mystery to the experts at the Whitecoat Investors. They see this type of investment behavior so often that they rank it as one of the seven top major financial errors physicians often make.

At Invent Wealth, we wish we could warn Dr. Lux. We wish we could help him rank his financial goals more carefully. We fear Dr. Lux will never retire early, and his financial illiteracy might cause early burn-out. But that is another story.

Physician’s Tax Mismanagement 2: Misunderstanding Taxes and Retirement Plans

Our second case of physician tax mismanagement is closely related to the first. Let us state now that, like the Whitecoat Investor, we are shocked that doctors have not discovered Backdoor Roth IRAs or Stealth IRAs. We have previously discussed how every dollar you save in a retirement plan can save you 40 cents in taxes. However, “many physicians do not know the type of retirement plan that will work best for them.”

A Few Basic Facts about Your Solo 401(k)

Now, hear this: “The mainstay of retirement saving for the self-employed should be an individual 401(k), sometimes called a solo 401(k).” Here’s are a few secrets Dr. Lux did not know.

1. Did you know physicians and entrepreneurs can make a $19,500 “employee” contribution. And if you are 50 years old, are you aware you can make a $26,000 contribution?

2. On top of that, did you know you can then create “employer” contributions of 20 percent of your net income? The government caps this contribution at $57,000. (Our figures are for 2020.)

3. Keep in mind you can only have one employee contribution no matter how many jobs or 401(k)s you have.

4. Here is the good part: The $57,000 limit is an employer contribution is a per-plan limit.

So let’s look at another example case, the sweet case of Dr. Kale.

The Smart Case of Young Dr. Kale

Dr. Kale works on the staff of a local clinic. She has an employee job and an accompanying 401(k.) Additionally, this ambitious and energetic physician also accomplishes some work as an independent contractor. She can open an individual 401(k) account. Then she contributes “just the employer contribution to it.”

Dr. Kale feels sympathy for physicians who invest early on investments other than retirement accounts. She knows they simply must not understand the strategy of utilizing these basic, tax-efficient self-investments in their own futures. She is currently learning how physicians shrink tax debt through Health Savings Accounts. We will soon be blogging about the advantages of HSAs. Dr. Kale has one, but does not yet understand how it helps her tax situation. Below we wrote a quick preview.

A Quick Taste of Another Way Physicians Shrink Tax Debt

In brief, “HSAs are typically offered by health insurance companies to individuals with high-deductible plans. HSAs allow you to save for medical expenses…” Dr. Kale will enjoy three major perks from her HSA very shortly, as tax time comes around.

- Her contributions will be tax deductible.

- Likewise Dr. Kale will benefit from withdrawals when she claims qualified medical expenses.

- Plus her contributions will accrue tax free interest.

There’s much more to tell you about Dr. Kale’s HSA, but, as we said, we are planning a blog exclusively about it. However, if are in a hurry, you can visit the above link to learn more about the ways physicians shrink tax debt with their HSA’s. Likewise, we invite you to call and arrange a visit with us about such matters. That is why we always say, “Got Questions? Ask Us.”

Terrific Take-Aways for Physicians Who Want to Shrink Tax Debt

In the big picture, physicians must understand that there are no once-a-year quick tax fixes to shrink tax debt, not even for doctors. If you want to make a real difference you might have to change your lifestyle habits and tax strategy throughout the year. Month by month. Week by week. We humbly suggest you max out your IRA contribution before you consider buying that new sailboat or invest in anything other than retirement.

We see many physicians operating as if they were brain-washed consumers. They are financing expensive toys and extravagant lifestyle choices on credit. Perhaps these physicians wish to be compensated for their long hours with bigger houses, better cars, and expensive vacations.

Financial Literacy and Living Your Best Life

To be totally honest, lowering your tax burden is more a function of changing how you live your financial life than simply preparing your taxes properly. These are activities the IRS looks on with benevolence:

- Marry a stay-at-home spouse.

- Give a present to charity.

- Take on a Mortgage within your means.

- Save for retirement.

On the other hand, the IRS does not like to see these the following behaviors.

- Marrying a high-earning spouse will not help reduce your taxes.

- Investing in hard money loans in a taxable account is also not wise.

- Likewise buying expensive luxuries instead of saving or investing for the future is detrimental to your tax bill, your peace of mind, and maybe your future.

In closing, Invent Wealth thanks you for reading our blog essentially about initial ways physicians shrink tax debt. As in the case of Dr. Kale, we have only touched the tip of the iceberg as we ascend the mountain of financial literacy for successful and truly wealthy doctors. Don’t worry, this mountain is not high or treacherous. It just takes a little time and a little study. Fiscal awareness is not brain surgery. Your path to success might have been neglected, deflected or misdirected. We are here to help.