Physicians’ Accounting 101 will contain the secret to financial independence, early retirement, and happiness. That’s a tall order. However, we intend to deliver some Gavrilov Gold. That’s what we have termed our business planning lessons in Accounting 101.

Although thisblog article was originally addressed to members of the medical profession, we are inviting all types of professionals to read it.

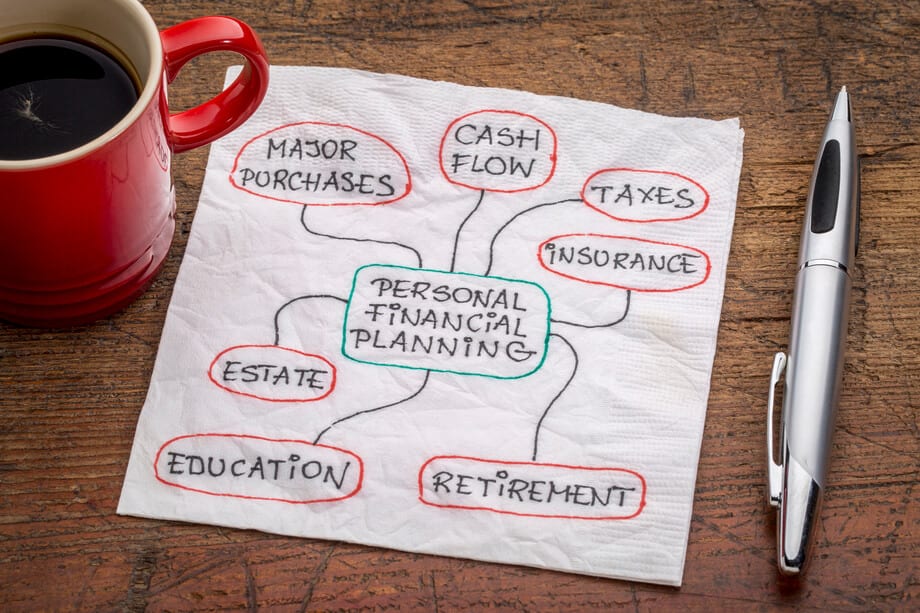

You see, we delve every day into helping medical professionals learn about their financial lives, wealth, tax strategies, and investment options. And we have realized that such financial knowledge could improve the lives of all professional people.

In Search of the Secret of Life through Physician’s Accounting

In our efforts to help physicians with accounting and bookkeeping services for their medical practices, we discovered a large, and you might think obvious, secret behind financial independence. Moreover, this secret is not cloaked in complex economic or financial theory. In fact, it is really quite simple. However many physicians, and other professional people don’t wake up to this secret of life until they are 50 years old. And it only involves a little bit of math.

Finding a Balance: Life, Work, Finances, and Happiness

According to the Whitecoat Investor, “Nearly every American willing to work at a full-time job has

enough money to meet all their needs…”

They can “purchase many of their reasonable wants, and quit working completely within a decade or at most two.”

However, we seldom meet a person who is actually financially independent at 35. Basically, we meet two groups of doctors:

- Firstly, those physicians who believe they can delay their financial independence a little bit and buy a few luxuries that delight them.

- Then, there are those who mismanage their financial lives so badly that they never get out of debt, much less achieve financial independence.

Physicians’ Accounting 101: Lesson 1–Learning to Save

In 2016, It is calculated that most Americans only saved 5.7% of their income. Later, according to financial Samari, it rose to 7.7 %. Therefore, with a little math, we see that after 13 years of saving at that level, you would only have a year’s worth of your living expenses.

But, under the stress of the Pandemic in April, it rose to 33%. In May, it sunk again, but only to 22%. Apparently COVID-19 has made many of us more cautious about how to save our money. We still have to admit that many of our clients continue to save at that 5.7% level. Sadly, they do not think they will ever retire, much less retire comfortably.

Observe a Few Statistics: Physicians’ Accounting 101, Lesson 2–Planning a Financial Life

So let’s check out and summarize the Whitecoat Investor’s mathematical wizardry.

- Small town rural Doctor “L” only makes $56,000.00 per year. However, he earns 5% real on investments.

- He and his wife, who works part-time as his receptionist, manage to save 20% of their income.

- The question is: How long must they work?

- And, following our Accounting for Physician’s 101, research, the answer is, they can retire on 80% of their income after 37 years. (Did you cringe?)

Let us quote, “It’s actually usually a little better than that since many expenses go away in retirement…” Additionally, “you pay much less in taxes when you’re only earning 80% as much…” Also, “you don’t owe any payroll taxes because it isn’t earned income.”

A Few More Cringe-Worthy Statistics or the Physicians’ Accounting 101 Lesson between the Lines

If they wanted to quit their 70 hours a week jobs at his practice in 30 years, how much would they

need to save? We calculate that it would be about 28% of their income.

- So what if they only wanted to work for 20 years? They would need to save about 43%.

- And if they only hustled for 10 years, they would need to save about 66% of their income.

Do you know that Dr. “L.”’s 56,000.00 a year income, although extremely low for a medical professional, is actually the Average American Income?

If he can do the above, just think what attending physicians should be able to do in—say, 10 years?

We would think that 10 to 20 years would be enough for a comfortable retirement. This is of the higher level of income of physicians, typically 100,00.00—200,00.00 per year. However, that is far from true. And it would be true–except that maintaining a doctor’s lifestyle, self-rewards, and lack of a fiscal plan sometimes turns into overwhelming debt. That’s what we called the “lifestyle creep” in a previous blog.

Physicians’ Accounting 101-Lesson 3: Upgrading Your Lifestyle

Whitecoat Investor says, “When you do upgrade your lifestyle, remember that 5 times the pay doesn’t equal 5 times the lifestyle.” If you are crossing the threshold from residency to attending, watch out for new financial responsibilities.

1. Did you know you will pay more in taxes?

2. And look out for business and CME expenses!

3. Will your family expand? (“Many doctors in their first years out of residency will find more mouths to feed at their tables.”)

4. Be aware fancy vehicles require more gas.

5. That big house costs more to maintain and furnish.

6. To save your standard of living, you must begin to put away some serious savings for your retirement.

If you are unaware of the above list and sink yourself into debt to maintain a fancy lifestyle, then in the words of Mr. Money Moustache, you will have run “up the hill of challenge and right off the cliff of success.”

Physician’s Accounting: Terrific Takeaways and The Secret of Life

Thank you for reading the Gavrilov & Co blog. And yes, there will be a Part Two, next week. Finally, oh, yes, we promised you the secret of life. We believe, with all our financial wisdom, that you cannot find happiness through buying things. (Additionally, we are including abstract acquisitions like status.)

We are not going to turn all preachy here, but the sooner you learn to believe that concept, the sooner you can retire. (By the way, if you only save 5.6 percent of your income, you cannot retire until after you put in 63 years of work. And that holds true, no matter the amount of your income.)